|

30 in 3 sounds to good to be true and it is

by Dan Dodson

New Jersey really is a taxation basket case. While some states like Texas and Florida have no income tax and New Hampshire and Delaware have no sales tax, NJ has both and some killer property taxes to boot (try 4.02% in Trenton). According to retirementliving.com, NJ ranks 14th among all states for the heaviest tax burden. Between state and local taxes we pay 10.4% of our income on taxes. You would think that in a densely populated state like ours, government services could be efficiently provided. In a state where the per capita income is second only to Connecticut you would think our tax burden as a percent of income would be lower. You’d think.

Politicians are quick to blame the other guy for our problems and universally point to corruption and lack of discipline in the other party. It seems as though this has always been the case. In this year’s gubernatorial race we have the fortune (I think) of having two multimillionaires running against each other who pitch themselves as being above all of this unseemly corruption.

John Corzine is pitching rebates to seniors along with a promise to root out

corruption. He’s suggested that the constitutional convention is a good

idea yet he doesn’t suggest an approach that might come out of such a

convention. Corzine is pitching more of the same and therefore provides an opening

for creative Republican ideas.

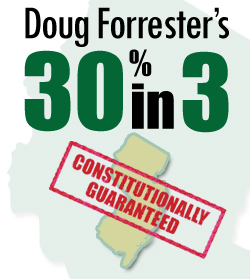

So along comes Doug Forrester with a catchy plan to reduce property taxes by

30%. Hopefully smart NJ voters understand that the plan simply moves the money

from one bucket to another with no real guarantee that money will be saved.

That said, the plan was attractive for its potential to break the system.

So what’s wrong with Doug’s plan? Why is a moderate Republican like myself spending so much time arguing against it?

The 30 in 3 plan makes it 30% easier for local politicians to do the wrong thing! Lord knows they don’t need any help with that. With 30% of the tax burden taken off local politicos, they’re 30% more likely to forget they need to correct their tax problems.

My town, Trenton, has raised the tax rate each of the last 3 years. We're currently at 4.02%. Even though our taxes are high, Trenton still pays only 10% of our school budget. Our problem isn't necessarily overspending; it’s an anemic tax base. How will taking the pressure off of Mayor Doug Palmer fix that problem?

It won't, it will make it 30% easier for him to continue ignoring the need to attract wealth to the city. Palmer likes to maintain programs for the poor in Trenton; it makes him popular with his base. The only thing that makes the Mayor unpopular is the tax bill and Forrester wants to fix that problem for him. I didn’t realize they were that close.

In wealthier areas it will be 30% easier to jack up taxes to pay for new schools.

Suburban districts will find it easier to add family housing even though their

populations are hopelessly over-weighted with school aged children.

It shouldn’t be easier for local politicians to do the wrong thing, it

should be harder.

The second problem with 30 in 3 is that the state is a poor steward of our tax dollars.

Forrester’s central message is that the state will act on behalf of citizens to pressure local governments. That’s great but who’s watching the state. Won't legislators protect spending in their districts? Won't this stimulate pork barrel politics?

Local budgets are already subject to state review. By statute, local budgets can’t change (up or down) at more than a prescribed rate per year. We’re not really in danger of runaway taxing that a state auditor might catch. Forrester claims that local spending caps are part of the 30 in 3 plan but actually they’re already on the books and apparently haven’t helped a thing.

And what about the state auditor that Forrester claims will clean everything up?

Suppose West Windsor wants to build a new arts center or hire a nature interpreter. Some might call this wasteful. Suppose Trenton wants to double overtime for police, some might call this bad management. Will the state have an effective veto on such spending? If it doesn't, how will the state actually control local spending?

Who in state government will decide that police spending in Trenton is OK and arts spending in West Windsor isn’t? The auditor? Certainly such a state auditor will need to be wiser than all of NJ's city councils put together.

Forrester’s basic argument is that local government will be more responsive to state government than to voters. The corollary argument is that state government should be trusted more than voters to pressure local government. Voters certainly don't trust the state to mind its own budget. Therefore voters won't react well to this argument.

A better approach is to attack our problems directly.

When you talk directly to the Forrester campaign they’re quick to package

30 in 3 with several other cost saving initiatives, like Pay to Play reform,

pension reform and other unspecified tools for holding down local spending.

We don’t need 30 in 3 to have statewide pay to play reform. Forrester

should campaign on this issue directly. It’s not like New Jerseyans don’t

understand the issue.

Forrester claims that 30 in 3 will make it harder for local governments to pad the pensions of part time government workers and political friends. Maybe, but why not attack the problem directly by banning the process of extending pension benefits to part timers. Better yet, why not phase out the pension system all together in favor of a retirement saving plan similar to a 401K.

If Forrester has some miracle tools that local politicians can use to hold down spending, then by all means he should talk about them and make then available to governments while they still have the pressure of a full tax burden to put them to use.

Because it can be shown that 30 in 3 is bad idea likely to generate unintended consequences, the Forrester campaign should abandon 30 in 3 and suggest a better approach.

My original attraction to 30 in 3 was that it might break open our tax system. It’s true in business and in baking that sometimes you have to break a few eggs. 30 in 3 doesn’t break the system, it bends it the wrong way. However there are numerous ways to break New Jersey’s tax problem wide open and I’m offering up a few as political conversation starters.

For example, why not create a referendum process whereby citizens can cap their own tax rates. Imagine angry voters passing local referendums limiting their property tax rate to 2%. Harsh, but effective.

Here's another one – the state should take over all the public schools. This will give Forrester an opportunity to attack a real problem, the fact that NJ has the fourth most segregated schools in the country. No more squabbling over school budgets, no more home rule and no more segregated communities. For the first time all of us would be in it together.

And finally the really big property tax idea: tax on acreage rather than property value. I’m not crazy enough to suggest that this could be done quickly; in fact it would have to be phased in over a long period. But, imagine land based taxation’s chilling effect on sprawl, its stimulative effect on dense development in cities and its curb on the practice of chasing ratables.

30 in 3 is fraught with the danger of unintended consequences, therefore the Forrester campaign should realize their mistake and up the political ante with some new ideas.

####

Dan Dodson is a management consultant and Leadership Trenton Fellow.

Copyright 2005, Dan Dodson