Archive for 2014

Trenton’s taxes are higher than Princeton’s. You’re kidding right?

A neighbor pointed out that Trenton has the highest effective tax rate in Mercer County and another neighbor blamed Governor Christie for it while also suggesting that Princetonians shouldn’t complain about their taxes because Trenton’s tax rate is so much higher. Rather than tie up the neighborhood e-group I thought I’d comment further on Reinvent Trenton.

Trenton has had the highest effective tax rate in the entire State of NJ (not just Mercer County) for a long time. Trenton’s rate is 4.753% and Princeton’s is 2.031%.

Mercer County Tax Rates by municipality

Despite any partisan claim that this is somehow the current Governor’s fault, we’ve had the highest rate since as long as I’ve been tracking it which goes back to Corzine and McGreevy. If one wants to assign blame, we’ve had Democratic Mayors for the 24 years it took for our tax rate to climb to where it is.

And while we’re on the subject, let’s not forget what the situation would be if we weren’t an Abbott school district (that’s what you are if you’re so destitute that you can’t pay for education), our tax rate would be double than what it is now. The State pays for our public schools.

However, The comparison to Princeton is correct. People are generally oblivious to their tax “rate” and instead focus mistakenly on absolute value of the tax bill. It’s our tax rate (in some cases higher than mortgage interest) that scares away new investment.

We do not have a cost problem.

Our costs are comparable to similar cities. Politicians like to suggest to citizens that they are cutting costs but in a city like ours, that’s like cutting bone, a bad idea. Even our wasteful spending on parades and festivals is just a drop in the overall budget.

One notable exception is that Camden’s (a city with slightly lower median income than Trenton) policing costs are now much lower than Trenton’s and for what appears to be a superior level of service. Camden’s solution was drastic and many people (mostly those in police unions) deride it. Nonetheless regionalization (whether its union busting or not) should be considered.

While we can certainly be smarter about our spending, it’s not the big problem.

Our Big problem is revenue!

Hopefully everyone in Trenton is up to date on the drivers of our municipal and school budgets and the actual structural problems as they relate to State payments to Trenton (CMPTRA formulas, Energy Tax Receipt formulas, State PILOT payments, Transitional Aid and Abbott funding). All of these sources measure in the millions. Our immediate problem with the state is that the formulas are either incorrect, not being maintained or both.

Federal law prevents Municipal governments from taxing State governments. That hasn’t prevented other state capitols in this country from being successful cities. If one investigates some of those cities (“Fix Trenton’s Budget” did a few years ago) they find that NJ’s compensation package to Trenton is on par or better than most. It’s what we’ve done with our limited resources that has caused the problem.

Trenton has been shortchanged on CMPTRA (includes taxes on business that the state collects on our behalf) and Energy Tax Receipts (state collects money from for energy companies on our behalf). The previous administrations (Mack and Palmer) were asleep at the wheel on these issues. We’ve forfeited millions of dollars (at last count over $20M as I recall). Meanwhile the league of municipalities has spearheaded an effort to fix this. Our current admin and council are somewhat more familiar with the subject and will hopefully lend Trenton’s weight to the effort to overhaul this payment system.

The fundamental problem revenue side of the equation. Not one single policy has been enacted to drive investment in Trenton since I’ve lived until this week. The “Vacant Property Registration Fee” measure is the first policy I know of in the last 14 years that seeks to stimulate an increase in our tax base. The proposed property revaluation would be another and if we get our act together on use of the Abandoned Properties Act and Homesteading (buying City owned houses for $1) those will be 3 more.

We’ll continue to have the highest tax rate in the state until we straighten out our revenues. Cutting costs is easy, anybody can do that and then not take blame for the results. Fixing a city’s revenue picture takes imagination and thought.

Another anti-revitalization idea to defeat in Trenton

It might be humorous if it weren’t so tragic.

Trenton is awash in crime, losing its tax base and graduating only half of its high school students. And yet, Mayor Eric Jackson at the behest of a group of special interests along with 2200 Trenton citizens is seeking to make Trenton an even more expensive city in which to do business than its neighbors and the country in general.

The Mayor proposes to force ALL businesses in Trenton to pay for sick leave for all employees.

While I’m sure this is a lovely idea to some, the fact of the matter is that this no different than the City of Trenton requiring businesses to raise pay. Apparently the Mayor thinks Trenton is influential enough to get away with setting a national trend.

He doesn’t get it.

Trenton is a business backwater with a GDP that some have estimated is smaller than a single shopping center in Hamilton. That’s right Hamilton Marketplace generates more revenue than all businesses in Trenton put together.

And yet Hamilton isn’t leading this charge. Neither is Yardley. Neither is Princeton.

The citizens and Mayors of those towns know that municipalities don’t set national policy. They know that creating a positive business environment is necessary for economic solvency. Mayor Jackson has something else in mind. He apparently suspects that by appearing to help the poor folk of Trenton he will gain political currency. After all who will be able to link this arrogant policy decision to Trenton’s underperformance vs. the regional economy? Yours truly is the only person in town who actually tries to measure our performance vs. the State and nation. Regular Trentonians will never attempt to link policy to result.

City Council members will undoubtedly fall in line with this ordinance absent an organized protest by the business community (though the North Ward Councilwoman has registered her opposition). There really aren’t enough business people with employees left in Trenton to even organize a protest. Many of the independent business people left don’t know about this measure. It’s been put on Council’s docket rather suddenly and even if they do know they won’t have time in their busy lives to spend 2 hours at a City Council meeting waiting for a chance to defend their right to run a business as they see fit.

Let’s be clear about this. We’re talking about the type of policy that is best enacted at a national level so as to not disadvantage the economy of one state over another. Minimum wage policy, social security, work week duration and child labor laws are examples of similar policies.

The City of Trenton has no business going out on a limb to enact policy that is blatantly anti-business. We’re a small poor city in a small state surrounded by local governments eager to attract new investment. We already create a bad environment for business through our antiquated inspections processes, our repressive property tax rate, our high crime rate and our “2nd lowest in the state” household income. We can’t afford to gain an even worse reputation for business climate.

We all know Trenton is in Rough Shape

Now that Mayor Jackson has taken office it’s squarely on his shoulders to not just talk but to show results in improving Trenton.

We all express our displeasure differently. Residents, business owners and those considering a move to Trenton say it in many different ways:

- “Things have gotten bad”

- “Restaurants are moving away”

- “Trenton used to be great”

- “My taxes are killing me”

- “It’s not safe anymore”

We all have emotional responses to the situation we’re in and it’s difficult to put our finger on what bothers us most.

If we really think about it though there are five key indicators of Trenton’s health. Five symptoms that show how well we’re doing. And if all five of these indicators started showing signs of improvement, all Trentonians would notice the city coming back to life. If we could see progress in these five areas we’d have hope again that would be contagious.

The indicators are all well-known statistics that are easily and regularly measured in Trenton. They are:

- Crime levels as measured by the FBI’s Crime Index

- Population growth as measured by the U.S. Census Bureau (in the case of Trenton, every year)

- Graduation rate as measured by the NJ Department of Education

- Median Household Income as measured by the U.S. Census, and

- Economic success as measured by our tax base

To be a successful Mayor, Eric Jackson must lead Trenton to show progress on these 5 measures. It’s not nearly enough to say “I’m working hard”. Mayors have said that before and the problem was they were working on the wrong things. Doing the smart thing is much more important than working hard on the wrong thing. Over the next several years I plan to do my part by reporting to Trentonians on Mr. Jackson’s progress on these basic measures. I’m looking for results not promises of results.

The following is my initial report.

Our people are leaving the city

Trenton’s 2012 census estimate is 84,447 residents

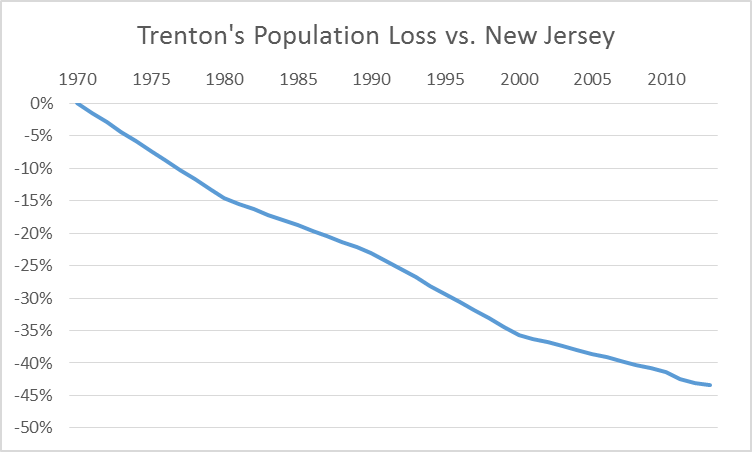

The most important measure is the simplest one, is Trenton such an attractive place to live that our population is growing. Unfortunately the current answer is NO.

- Since 2000 our population has declined by 1.2%

- Meanwhile New Jersey’s population has grown 5.4% in the same period

Relative to our neighbors, Trenton has become a less desirable place to live. Over the past 44 years Trenton has steadily under-performed with the State growing 43% faster than Trenton.

While New Jersey’s growth has accelerated Trenton’s population has shrunk. We benefit from the same factors that drive growth in the state so it is especially disappointing that Trenton continues to lose people. Some have pointed out that Trenton’s population loss has slowed, but that is blatantly misleading. It has only slowed because New Jersey’s growth has accelerated.

It will take an influx of new residents to begin the process of rebuilding our tax base. We have room to grow. At its peak in the 1920s, Trenton housed 140,000 residents.

Our economy is losing wealth

In 2011 Trenton’s tax base, the value of property on which we can charge a property tax, was $2,009,731,470. By 2014 it has declined to $1,993,783,800. This represents a .8% loss in ratables for the city.

The implications of this statistic are large. It means our economy is getting worse instead of better and most importantly, it means that our policies are not working.

We can never have a lower tax rate or afford to spend more money on parks, police and streets unless our ratables go up.

Our incomes are relatively low

Trenton’s Median Household Income is $36,727 (2012)

- This is in stark contrast to NJ’s median household income of $71,637, which is almost double that of Trenton’s.

- Hamilton’s median household income is $72,735

Worse yet, the percentage of households in Trenton with income over $200,000 is 1.6%,

- The compares poorly to 9.1% for New Jersey and 4.3% for Hamilton

- High income households spend money on amenities at a much higher rate than low income

Income levels are very important to the health of a city as they determine how much money residents will spend, which in turn, determine the attractiveness of a city to retailers and other amenities. While NJ’s median household income is double that of Trenton’s, NJ’s per capita retail spending is three times our rate. This means that retail spending falls off disproportionately to income.

Making Trenton attractive to retail and entertainment business is important as the presence of those amenities makes the city attractive to new residents and businesses but we won’t get new amenities without more spending power in the city.

Our children are dropping out of school

The Trenton school district’s 2013 graduation rate was 48.6%.

- This means that almost half of the students who entered 9th grade in 2009 graduated in 2013.

- There is no world in which this is healthy.

- It can be argued that fixing the schools isn’t a prerequisite for revitalizing the city. The easiest target market for new residents is the millions of people without kids. However, failing schools don’t help.

With 50% of our young adult population grossly under-educated, they are likely to become a drain on the economic future of our city. High school dropouts are more likely than graduates to turn to crime and create a social cost for the rest of us.

The cumulative effect of moving the graduation rate up to 75% could halve our crime problem in the long run if the correlations between dropout rate and crime follows.

Our crime rate is still high

Trenton’s crime problems have tracked the national trend downwards over the last decade.

Uniform Crime Reports for 2013 are 3443

- This is a decrease from 2012 of 14% which shows we’re moving in the right direction,

- However in 2013, Trenton set a murder record of 37 which placed it among the most dangerous cities in America.

- Meanwhile neighboring Hamilton had a crime index 2057 and only 1 murder in 2013.

There is a direct correlation between population decline and crime

In “CRIME, URBAN FLIGHT, AND THE CONSEQUENCES FOR CITIES”, economists Julie Berry Cullen and Steven D. Levitt found that each FBI index crime leads directly to one person moving out of an inner city, like Trenton. That’s bad enough but high income residents are 5 times more likely to leave due to crime than average. Families with children are 3 times more likely to leave. Finally crime rate is negatively correlated with depopulation, home values and per capita income.

These conclusions alone are quite damning for Trenton. However, it gets worse. If a city becomes depopulated, the crime rate goes up because the criminals stay behind. Also, because high income people leave, poverty becomes more concentrated.

We don’t have a lot of flexibility in our budget to fix things

Our expenses can’t change much

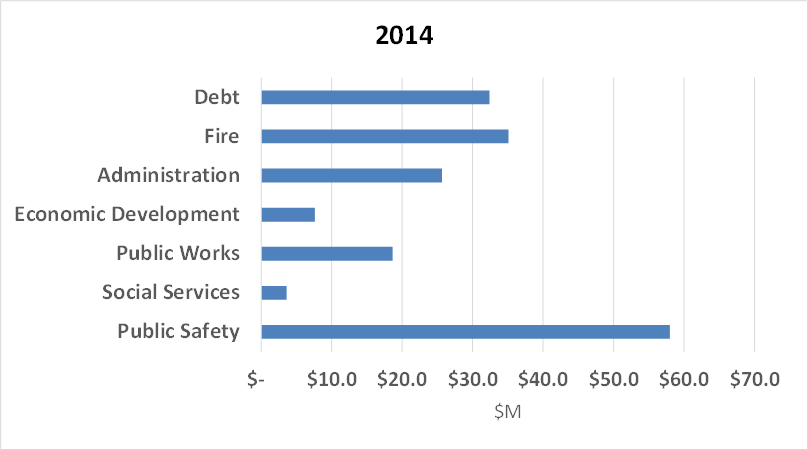

Debt, fire and police make up almost all of the budget and other functions are cut to the bone.

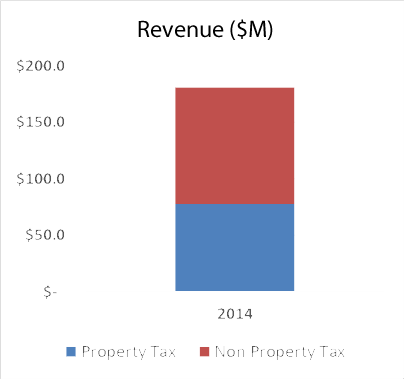

Our revenues can’t change much either

Property tax makes up less than half of our budget so any change in the budget will have a large effect on taxes.

This is a complicated problem

A city is a complex system. When dollars are invested in crime fighting in one part of the city, street paving may go undone in another. That lack of street paving may have a larger or smaller impact on investment in the city than the crime fighting.

Investment will lead to a higher tax base but not for some time. In the meantime, there may not be enough money to fund basic services and taxes have to be raised.

Higher taxes will devalue the investment, leading to lower than anticipated increases in the tax base.

And so it goes in any economy. 1st and 2nd order causes and effects are at play making seemingly simple policy decisions difficult. This is especially problematic in an environment where the public doesn’t appreciate the non-intuitive nature of such decision-making.

How can we turn this city around?

We’re in a vicious cycle

- High crime leads to depopulation and greater expense in policing

- Depopulation leads to higher taxes which drives people away faster

- In a city where almost half of its budget is fixed on debt services and benefit obligations, our ability to fund discretionary budget items such as city services is limited

- Lack of services drives people away even faster thus creating a vicious cycle.

How can we turn a vicious cycle into a virtuous circle?

- A virtuous circle is the opposite of a vicious cycle

- Good things build on one another

- Eventually enough good things happen that they overwhelm the bad things and the city grows despite itself

- This is happening in some cities in America like New York and Washington and even New Brunswick and Jersey City

Mayor Jackson will do well to ask himself every time a program or initiative comes across his desk, “How will this move the needle on these five basic measures of a city’s health?”

What should a Mayor of Trenton ask of New Jersey?

Historically (before Mack and Christie) the state funneled four main sources of revenue to Trenton: Capital City Aid, CMPTRA, PILOTs on State Buildings and Energy Tax Receipts.

Two of those sources, CMPTRA and Energy Tax Receipts, are meant to be pass-through payments the state collects from corporations on behalf of every city in NJ. CMPTRA includes business taxes (but in the case of Trenton also included some ill-defined PILOT payments). Energy Tax Receipts are paid from utility company fees. It turns out that the State has been shortchanging cities across NJ for many years in both of these revenue streams. Neither of them have transparent funding formulas. The NJ League of Municipalities has taken the State to task over this but Trenton has been silent up until now. Support for A-2753 to end diversion of Energy Tax Receipts is especially important.

There is no very accurate measure of the level that we have been shortchanged but experts in Trenton estimate the amount to be in the millions. The next Mayor of Trenton will add his voice to those of other municipalities in formulating a better mechanism for transferring the money that rightly belongs to the cities.

The State discontinued the Capital City State Aid program in 2011. It was essentially replaced with Transitional Aid though, at a lessor amount as you can see in the revenue charts below. Capital City State Aid was a very undependable source of funding because it had no formula and was supplied through a yearly act of Legislation. Obviously this Governor has decided that this outright grant is untenable. I agree with him.

Transitional Aid was meant to be transitional, a gradual decrease in State funding with a lot of conditions monitored by the Dept. of Community Affairs (DCA) but really, the State wanted a plan to revitalize the city, a plan that it never got. All of us in Trenton are aware of how that has gone under the Mack administration. Because DCA and the Governor couldn’t trust our former Mayor, funding was cut and the restrictions became tighter.

The final form of funding is what’s most important for our future relationship with New Jersey. Several State owned buildings in Trenton have had negotiated PILOTs with the City. There is no rhyme or reason to this other than it was a mechanism in which to transfer additional funding to the City for various reasons. Only a handful of State buildings have PILOTs. The total amount comes out to about $9M. This is an ad hoc approach to funding.

No State in the U.S. has any obligation to pay a City anything. Governments can’t tax each other. However, many States understand that especially in Capital cities the state is a major property owner and employer and must behave more like a corporate landowner. I propose that we formalize this approach through negotiation and State legislation to generate a funding PILOT based on either the assessed value of State land in Trenton or the proportion of land owned by the State. The Fix Trenton’s Budget group has analyzed this issue by examining the city’s tax rolls and report that the State of NJ owns roughly 19% of all property value in Trenton. However, we have reason to believe these values are under-assessed by quite a bit (perhaps 50%). Additionally, the State owns about 28% of the acreage in the City.

The question is, if the State were taxed like a corporation, what would it pay?

Let’s say that after a reassessment the State is found to own 30% of the land and property value. Total values in Trenton are roughly $4B. Our current tax rate is 3.85%. Therefore the State could theoretically pay 30% X $4B X 3.85% = $46.2M. This is more than it pays today in Transitional Aid and PILOTs (roughly $32M) but less than it did in 2010. This is a good formula.

Trenton is in a dire situation though and we do need the State of NJ’s help in recovering from this. Our next Mayor will do well to ask for State assistance in many areas mainly around legislative relief to overhaul our tax system and create incentives to invest in Trenton. In the meantime we will request that Transitional Aid be maintained until our economic plans can begin to bear fruit, likely 4-5 years.

Jim Golden’s Trenton Forward plan is unique in that it includes a detailed plan to revitalize the city that specifically seeks to rid us of the need for transitional aid as long as our funding formulas can be formalized. The BIG goal in that plan is to make Trenton much more self-sufficient. Our lack of self-sufficiency puts us all at risk because our budgets will be uncertain. We’re entirely too dependent on the whims of a Governor or Legislature.

Trenton Revenue Source Comparison

Source: Trenton City Budgets, Fix Trenton’s Budget.

Trenton Forward “Asks” to New Jersey: Beyond the Funding Formulas

- Support for consulting project to define and implement Best in Breed

- Seek a Land Value Tax capability to replace PILOTs and Vacant property registration fees

- Allocate $50M to a Residential Investment subsidy over 10 years

- Enact enabling legislation for Income Tax Credit Zone that caps state income taxes in Trenton

- Continued funding for temporary police assistance

A Plan for Addressing Vacant / Abandoned Properties in Trenton

The fundamental reason Trenton has abandoned / vacant properties in Trenton is that it costs more to rehab a property than it would be worth once completed. We can help developers and potential homeowners by lowering their financial cost, establishing a more fluid market for vacant / abandoned properties and creating a marketing message that includes more people who might be interested in living in Trenton.

I estimate the number of abandoned / vacant properties to be over 3,300.

In general Trenton will have to attack the problem of revitalization of abandoned / vacant properties one neighborhood at a time starting with downtown. We don’t have the resources, yet, to address the entire city at once.

Our efforts will address both city owned and privately owned abandoned, vacant and underused properties. For city owned property our goal will be to get them on the tax rolls, not make money from selling them.

1) Lower the cost of revitalization

Enhance our tax and subsidy package for redevelopment

- A standardized Revenue PILOT for large projects reduces risk for developers and provides transparency for all taxpayers into how the city works with large developers

- A graduated abatement on improvements of up to 15 years. This includes the existing 5 year abatement plus a new abatement in redevelopment areas as per NJ law

- We will add an additional subsidy on improvements in the downtown district

Reduce risk for redevelopers by

- Improving the public safety situation while development is going on

- Increasing code enforcement on adjacent buildings in focus areas

Launch Homesteading in a few neighborhoods

- Properties will be sold to homeowners for $1

- Abatement Programs will apply

- Buyers will be matched with local contractors and architects where needed

- Neighborhoods will apply to participate and will be required to show support

Demolition: where a buyer wants it and our professionals agree it’s appropriate, we will sell a property to a developer, cleared.

2) Establish a more fluid market.

Use the NJ Abandoned Properties Act in Trenton for the first time. It’s been used now in Jersey City

Track all vacant properties with help from

- Efforts from non-profits like Isles, TCCA

- Expanded responsibilities in our economic development and inspections department to track and identify vacant properties (our proposed budget will include funding for this)

- Making a city-wide ticketing system available that allows residents to report abandoned properties

Outside Legal help on Closings to speed up a process that has been woefully slow and disorganized

4 hour inspections appointments instead of the current practice of allowing 22 days to review simple plans

3) Create demand by

Establishing a public / private marketing entity “Trenton Sells” co-founded with realtors and developers. This group will be the conduit for our marketing efforts. It will:

- Publish a web site and newsletter

- Target Millennials along the Northeast corridor

- Publish our vacant property inventory on the web site

- Hold regular Open houses for the city

Matching up homebuyers with architects and contractors. We can make renovation easier for buyers buy helping them find local development help that knows how to work in Trenton

Developing a neighborhood level branding plan. Neighborhoods will have the opportunity to sell their neighborhoods by establishing the right message. Hopefully the Master Plan includes this work

Pitching to New Urbanist Developers. There are developers who specialize in building urban neighborhoods. They are part of a large and growing national trend. A revitalization-minded Economic Development department will seek out these developers and invite them to Trenton.

Key Reorganization tactics

Reorganize inspections under the Economic Development Department. This will focus inspections on the job of meeting our goals

Set measurable goals that require us to put property back on the tax roles

- Increase our ratables by 10%

- Increase our population to 90,000

- Track our progress on reducing abandoned properties

State regulatory Asks

The job of a Mayor is to make sure the State is working for us, not against us. A Trenton Mayor should work with our legislative team and urban Mayors across the state to enact pro-redevelopment legislation.

Land Banks: Potential enhancements to our ability to use Land Banks beyond what is currently in the Abandoned Properties Act. We want to provide mechanisms engage for-profit firms to help and to make sure our laws help us deal with quiet deeds and that they don’t prefer subsidized housing.

Land Value Tax: A two tier tax system can be used to make it harder to hold on to vacant land and profitable to develop it. Land Value Tax legislation would provide a cleaner mechanism to encourage redevelopment than tax abatements as it would be available to all property owners.

Urban Income Tax Zone: Push to have Trenton become a test city for an urban income tax zone. The maximum income tax bracket in Trenton would be set at 2% instead of 5% making it very attractive for higher income New Jerseyeans to move to Trenton.

THE WORST MAYOR IN THE HISTORY OF BAD MAYORS

No clever new policy idea today. Because what would it matter? Trenton is governed, at least legally, by the worst Mayor ever. I’m mad. All Trentonians should be mad. Our City Council members should be furious, except for the worthless three who’ve propped up the Convicted Occupant of the Mayor’s Office, Tony Mack.

I’m so mad that I think of storming City Hall often. I imagine thousands of angry citizens with torches and pitchforks, busting through security up to the Mayor’s office and knocking down the door. I think of riot police with tear-gas being forced into duty.

I envision CNN, ABC and the BBC covering the riot with choppers and camera crews.

Then, after days of international media coverage, the Attorney General refers the matter to the State Supreme Court. Out of fear of more public backlash, the court rules on the matter and sends Tony Mack to the deepest pit of prison hell, takes away pensions and for good measure re-writes our statutes concerning succession. Out of fear for their political futures (and a bit for their physical well-being) the legislature pass it in a week so this travesty never happens again.

You’ll excuse the vitriol. It’s been 3 ½ years of suffering this fool and I’m tired and angry.

A Downtown Investment Program for Trenton

Many things have led to Trenton’s economic problem but they aren’t unique to post-industrial America. If you don’t understand how it happened I can recommend some books.

The question is how to turn it around. Some cities have. Some have done fairly well simply by having good leadership over the years. Trenton, like Detroit, hasn’t been that fortunate.

We’re in a situation where brave leadership will have to offer creative solutions.

Our crime situation can’t change quickly. Our public schools can’t change quickly. Our taxes are chronically high because our tax base funds only 1/3 of our budget. Therefore we can’t afford to invest much more money into police, schools or infrastructure.

So what can we do?

I suggest that we create a Downtown Investment program that seeks to increase our tax base to a point where it can once again fund city services. It has three key elements:

1) Fund an investment subsidy of 10% on any rehab investment of over $100,000. Because our tax rate is currently 4% well will recoup this investment in under 3 years, a 33% ROI. This will be available only to market rate, residential development not seeking abatements or PILOTs. Residential investment needs to come first and will eventually drive retail and commercial investment.

2) Target millennials and professionals with no kids. Over 1,000,000 people like this live within 30 minutes of Trenton. This is mostly who’s bought in Trenton over the last 10 years and it squarely fits the broader demographic trend towards America’s urbanization. A marketing program (web site, newsletter, some advertising, open houses, Realtor and developer organization) will embody this targeting.

3) Start small and offer the program (for now) only in Downtown Trenton. Scholars and Trenton activists have long pointed out that revitalization efforts need to be focused and start at the center. Trenton has had problems with execution in the past, starting small will let us see whether this works, and fix it if if it needs fixing. Downtown is the place to start as it allows us to spread outwards from there. If it’s successful downtown we’ll expand the program, one neighborhood at a time.

With modest investments funded just out of our budget, we can hope to increase our tax base from just under $2B to over $2.4B in 10 years. State participation in the program will help and other policies could also speed up the process. This will stop our vicious cycle of decline and start a virtuous circle of revitalization.

Now is the time for Steady Stewardship

Few Americans will ever see civic corruption as up close and personal as Trentonians have recently. Now that our 3 ½ year ordeal has been ended by the Federal Government our first inclination as citizens is to react. I know I have already, especially at the public figures who supported or refused to denounce Tony Mack even in the face of his obvious misconduct as Mayor, even before his arrest.

But we have only 5 months until we elect a new government. That new Mayor will have all the latitude in the world to reorganize and reinvent Trenton’s administration. He will be able hire new people and perhaps let some poor performers go. He will be able to close down operations that don’t make sense anymore or aren’t critical to our functioning as a city. He’ll be able to put in place systemic changes to our tax, development and policing policy.

What we need now is an Acting Mayor who will allow his Directors to be open and transparent, who will question spending and who will put on a trustworthy face to the rest of the world, especially the State. We don’t need new policy from an Acting Mayor. We don’t need new programs. There simply isn’t time. With the exception of a few dismissals of employees who have deliberately ignored Council’s directives and needlessly withheld information, there should be no mass firings. Instead, an Acting Mayor would do well to help the candidates prepare their policies by opening up the books and processes to those campaigns.

All indications so far seem to indicate Council President Muschal will take the “steady stewardship” approach. Let’s hope he keeps a cool head and does his part to insure the public makes the smartest choice it can for our next Mayor.

“The End of the Suburbs”

The End of the Suburbs: Where the American Dream is Moving by Leigh Gallagher is a wonderfully accessible book for beginning urbanist that need grounding in the demographic trends that are creating opportunities for cities like Trenton.

Last year the Trenton Times carried a review of the book but it seems appropriate for Reinvent Trenton to add a few words.

Ms. Gallagher has honestly built her narrative of the drivers of new urbanism on the backs of authors that have come before her including Jane Jacobs, Richard Florida and James Howard Kunstler. This is important for Trentonians attempting to come up to speed on the best thinking about what can drive Trenton’s growth.

The basic theme in Gallagher’s book is that fundamental demographics and attitudes are driving a shift back from suburban to urban living. This is good news for cities and bad news for suburbs that have likely overextended their spending and debt.

The demographic trends involved include an older child bearing age, lower number of married couples and therefore fewer children. This, coupled with a shift in attitude amongst millennials that shows a preference for urban living and against owning a car, has started a profound shift in American lifestyle.

The trend has been with us for many years says Gallagher but become most pronounced during the Great Recession that has left great swaths of suburban McMansions abandoned while home values in cities suffered only slightly. In fact cities are now growing at a faster pace than suburbs and according to Gallagher, home builders like Toll Brothers, the Godfathers of the McMansion, have noticed. Builders have shifted their efforts to building luxury condos, lofts and New Urbanist development that mimic older cities.

Cities like Philadelphia, New York and Baltimore have already felt the benefit. New Jersey towns like New Brunswick, Montclair and even the post-Sandy Jersey Shore are being built with a New Urbanist feel.

The question for Trenton is will we lift a finger to ride this fundamental wave of migration?

For us it means pitching developers like Toll Brothers on our city, offering a sane development environment that works with developers instead of against them. It includes a new tax structure. It includes increasing our walkability, perhaps by rethinking our transit system in favor of trolleys. And most of all it includes a small well-disciplined government that can support new development.

There are millions of young people living in our region who, given the opportunity to live in a great urban space would jump at it. It’s up to Trenton to make help facilitate an environment that allows buyer and seller to come together. We’re not there yet, but I can see Jane Jacobs vision of a city that constantly reinvents itself coming to life here.

I recommend The End of the Suburbs: Where the American Dream is Moving by Leigh Gallagher to Trentonians hoping to get an easy to read overview of our city’s possible future ($14 from Nook).

For me the other refreshing story here was who recommended the book to me. I’ve read quite a few books on cities and have publicly bemoaned the fact that Trenton’s politicians appear to be under educated on the latest thinking. However, in this case mayoral candidate Jim Golden recommend The End of the Suburbs and I jumped at the chance to read what was driving his thinking.

She didn’t stand for the foolishness

The news of Trenton City activist Pat Stewart’s passing has hit me hard.

It’s difficult to let a friend go, especially one that you’ve stood beside for so long and in so many capacities. I can’t remember exactly when I first came across Pat Stewart. I was new to Trenton’s political scene and Pat seemed to know everybody. Everybody.

But no matter who she was talking to, whether friend or not, she spoke her mind including to me. Pat would not tolerate what she saw as foolishness. And frankly we’ve had more than our fair share of that in Trenton.

The Reinvent Trenton blog owes quite a bit to Pat Stewart. My first foray into real politics was with the Lamberton Historic District Committee over Doug Palmer’s plan to tear down the Kearney homes and replace it with a new government housing project. She couldn’t understand why we’d tear down one housing project which, in her words “was strong enough to withstand a nuclear war” just to build another one. We like to think that our efforts helped defeat that project. Because of that effort we now have very nice market rate (non-government) housing on that site.

Pat, along with that same group, rallied the South Trenton neighborhood in opposition to Leewood Development’s proposal (again with Doug Palmer’s support) to bulldoze 8 square blocks of historic housing stock along Centre Street. Though hers and the group’s efforts over 300 residents showed up at several citizen’s meetings to oppose the project. The opposition was eventually too intense for Palmer and Leewood and they retreated.

With these successes under her belt she encouraged former City Councilman Jim Coston to organize an urban studies book club for residents who wanted to be better educated about revitalization issues. For many of us, this group was our education. We read the literature on urban revitalization and invited guest speakers of national renown to talk with us. It’s an education that led directly to this blog. Pat Stewart was a ring leader of that group.

My affiliation with Pat has continued throughout almost all of my civic endeavors. She was a leader in the Trenton Council of Civic Associations and was vocal with the Trenton Republican committee. She joined me in Fix Trenton’s Budget and Majority for a Better Trenton. She put her hat into the ring in the 2009 Special election for South Ward Council and as everyone with an ounce of familiarity with Trenton politics knows, Pat Stewart was a fixture at City Council.

Pat, who was self-admittedly intimidated by technology, even started her own blog, Lamberton Lilly. She made short and to the point comments about the goings on in Trenton. She had a following.

Pat was everywhere and so much a part of Trenton for me that it I’m sure I will think of her often in the years to come. I know that when our next administration finally crafts a real strategy for Trenton and it includes a real marketing plan for our city, I’ll probably shed a tear and hope that Pat knows that her constant admonition has finally come to pass.

In many ways Reinvent Trenton has been written with Pat in mind. It puts into words the ideas she had in her head. I know this because she constantly encouraged and commented favorably on my articles. I knew I was on the right track if Pat liked the article.

Of course Pat’s influence goes far beyond what I know about personally. She was a leader in the STARS civic association for many years, sat on the Zoning Board and was recently appointed by City Council to sit on the Ethics Commission. These are places of honor in Trenton.

I know that her son Nicholas knows how we all feel about his mom. I also know that the most important thing for a family member to know when a loved one passes is that the loved one will be remembered. Nicholas, that is a certainty.